[Updated: Apr 30 2020]

Note: The situation is changing rapidly, and so do the requirements and benefits. We are trying our best to keep this page updated but the material may not reflect all the newest changes.

With the wide spread of COVID-19, many small businesses and their employees are being affected. A recent survey done by the Canadian Federation of Independent Business (CFIB) in early April saying around 30% of business don’t have enough cash to pay for April bills and 39% are worried about permanent closure. In order to reduce the economic impact to citizens and businesses, both the federal and provincial government have announced different programs to provide financial relief for those affected. While the full extent of COVID-19’s global impact is yet unknown, it is a good idea to take precautionary measures and gather information to protect yourself, your employees and your business. As the pandemic keeps spreading globally, our federal government is taking action to help Canadian businesses. On March 25, 2020 Prime Minister Justin Trudeau announced a $107 Billion economic aid budget to support Canadians and businesses. Here are some of the measures for Canadian small to medium sized businesses.

Canada Emergency Business Account (CEBA) (Updated April 16, 2020)

- The new Canada Emergency Business Account will provide funding to eligible financial institutions so that they can provide interest-free loans in the form of lines of credit to small business and not-for profits of up to $40,000 to businesses. A quarter of this loan (up to $10,000) is eligible for complete forgiveness.

- In order to apply for the loan, the small businesses or not-for-profits must meet the following requirements:

- The borrow must be a Canadian operating business as of Mar 1, 2020 with a federal tax registration

- In 2019 Calendar year, it must have a total employment income paid between $20,000 and $1.5M.

- The business must have an active business chequing account with its primary financial institution before Mar 1, 2020

- The business can only apply once through this program and it has intention to continue to operate or resume its operations after

- The funds can only be used to pay non-deferrable operating expenses such as rent, payroll, utilities, insurance, property tax and regularly scheduled debt service. The funds can’t use as a pre-payment or refinancing of existing indebtedness or as bonus or dividend back to the owners.

- The borrower agrees to participate in post-funding surveys conducted by the federal government or its agents.

- Once the loan approved, it will use act as a line of credit with the financial institutions, the interest rate and repayments are as follow:

- No interest and principle payment until Dec 31, 2022

- ¼ o loan forgiveness (a maximum of $10,000) is available provided that 75% of the loan is paid back on or before Dec 31, 2022

- Voluntarily principle repayments is welcome without any penalties nor fee

- For the balance not paid by Dec 31, 2022, the remaining balance will be turned into a 3 year term loan at 5% p.a. , paid monthly.

- The full balance must be repaid no later than Dec 31, 2025.

Canada Emergency Commercial Rent Assistance (CECRA) (Updated April 25, 2020)

All levels of government are working together to provide rent support assistance to businesses that are most affected by COVID-19. The program will provide loans to commercial property owners who in turn will lower or forgo the rent for small businesses during the months of April, May and June.

The commercial property owners are offered forgivable loans to cover 50% of these three monthly rent payments if the property owners agree to reduce the tenant’s rent by 75% for the three months. The government will the pay the forgivable loans directly to the mortgage lender. Canada Mortgage and Housing Corporation (CMHC) will administer and deliver the CECRA and is expected to be operational by mid-May.

Businesses, non-profits or charities that have temporarily ceased operations or have had revenue dropped by at least 70% with a monthly rent of less than $50,000 will be eligible. More information to come in the next few weeks.

Canada Emergency Wage Subsidy (CEWS) (Updated April 14, 2020)

To support businesses (both small and big companies) that are facing revenue losses and to find ways to keep employees employed, the government has implemented a temporary wage subsidy. This subsidy is a three-month measure that allows eligible employers to reduce the payroll deductions remittance required to remit to CRA.

- Eligible entities seeing a drop in gross revenues of at least 15% in March 2020 and at least 30 per cent in April 2020 and May 2020will qualify for the government’s 75 per cent wage subsidy program retroactive to March 15 2020

Eligible entities need to meet all of the following conditions:

- Eligible entities include individuals, taxable corporations, partnerships consisting of eligible entities, not-for-profits and registered charities.

- must have a payroll account with CRA on March 18, 2020; and

- will pay salary, bonuses, wages or other remuneration to an employee

The amount of subsidy is the greater of:

- 75% of the total “eligible remuneration” paid to a maximum benefit of $847 per week; during the “eligible period.” and

- 75% of the employee’s baseline remuneration or the actual remuneration paid, up to a maximum benefits of $847 per week. Whichever is less.

“Base line remuneration” is the employee’s pre-crisis remuneration (the average weekly remuneration paid to the employee between Jan 1 to Mar 15, excluding severance pay)

“Eligible remuneration” includes wages and taxable benefits but doesn’t include items like severance pay and stock options benefits.

“Eligible employee” is an employee employed in Canada. Any employees who have no remuneration for a two-week period during the qualification period is not included. For non-arm’s length employees employed before March 15, 2020 (for example the employee is owner’s spouse), the amount is limited to the least of:

- $847 per week

- 75% of employee’s “base line remuneration”

- The actual eligible remuneration paid

Businesses can just reduce their income tax withheld remittance by the subsidy amount. Companies therefore will be benefit immediately by reducing their remittances of income tax withheld on their employees’ remuneration. Eligible employers can start reducing remittances for any remuneration paid between March 15, 2020 to June 6, 2020.

The Revenue Test:

The eligible entities can use one of the two benchmarks for the revenue test. The can choose to compare their revenue of March, April and May 2020 to either:

- the same period in 2019

- an average of their revenue in January and February of 2020

Once the entity choose the benchmark, they must use it for the whole program’s duration. When calculating the revenue loss, the amount of wage subsides is exclude from the calculation of revenue.

To make the program more flexible, once the entity is eligible for a specific period, the entity will automatically qualify for the next period. This way, the entities can recover easier without losing the subsidy.

The Department of Finance Canada provide a summary table, reproduced below to show the claim period, required revenue test, and the reference period for determining whether the revenue test is met:

| Claim period | Required decline

in revenue |

Reference period

for eligibility |

|

| Period 1 | March 15 to April 11 | 15% | Mar 2020 compared to either:

· March 2019 · Average of January and February 2020 |

| Period 2 | April 12 to May 9 | 30% | Eligible of Period 1

OR April 2020 compared to either: · April 2019 · Average of January and February 2020 |

| Period 3 | May 10 to June 6 | 30% | Eligible of Period 2

OR May 2020 compared to either: · April 2019 · Average of January and February 2020 |

Credit Source: Finance Canada

With that said, there are a few details that all employers need to be careful about:

- The CEWS allows a group of affiliated entities to calculate consolidated revenue for testing and use that amount for each eligible entity

- employers need to keep a clear and detailed record of the subsidy calculation, including the total remuneration paid between March 15, 2020 to June 6, 2020; the amount of federal, provincial or territorial income tax remittance deducted and the number of employees paid in this period. More information on how to report his subsidy will be released in the CRA website in the near future

- the subsidy that the employer gets will be treated as business income in the fiscal year the subsidies received

- for eligible employers that decide not to reduce the remittances, they can request CRA to refund back the subsides in total to the company at the end of the year or transfer the subsidies to next year’s remittance

Flexible Businesses Filing and Income Tax Payment

It is more flexible now for businesses including self-employed individuals to file taxes. The CRA will allow businesses to defer until after August 31, 2020, the payment of any income tax amounts that become owing on or after March 18, 2020 and before September 2020. No interest or penalties will accumulate on these amounts during this period.

CRA will not start any new GST/HST or income tax audits for the next four weeks to any small or medium businesses.

- Allow businesses, including self-employed individuals, to defer all Goods and Services Tax/Harmonized Sales Tax (GST/HST) payments until June, as well as customs duties owed for imports. This measure is the equivalent of providing up to $30 billion in interest-free loans to Canadian businesses. It will help businesses so they can continue to pay their employees and their bills, and help ease cash-flow challenges across the country.

Emergency Response Benefits

If you are self-employed, contractors, artists, or gig workers who do not qualify for EI and can’t work due to self-quarantine, sick family members or lack of daycare.

The federal government will provide a taxable benefit of $2,000 a month for up to 4 months to support workers who lost their job due to COVID’s impact or are making less than $1000 a month but are not eligible for EI. They will get the support equivalent to EI. The Canada Emergency Response Benefit is accessible through a secure web portal. Applicants will also be able to apply via an automated telephone line or via a toll-free number. For more information on CERB click here.

This benefit is also administered through CRA and applicants also need to apply through CRA MyAccount.

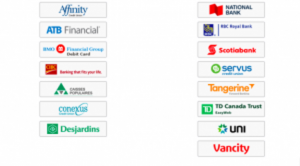

If you do not have a My CRA Account, it is time for you to open one. CRA needs to mail you an access code to complete the process so the registration will take some time. Click this Link to register CRA MyAccount. You can also access CRA MyAccount through your BC Service Card as well as thought one of the following CRA sign-in partner.

Source: Government of Canada